30+ mortgage calculator bi-weekly

Web 19 hours ago30-year Fixed Mortgage Rates. For purposes of amortization the calculator assumes you will make one extra bi-weekly.

Biweekly Mortgage Calculator Calculate Accelerated Bi Weekly Home Loan Payment Savings

The calculator will figure your bi-weekly mortgage payments for fixed-rate mortgages of up to 40 years.

. This means the debt will be fully paid off within 215 years instead of 25 netting you a 14610 saving on interest payments. This is a decrease from the previous week. Choose from 30-year fixed 15-year fixed and 5-year ARM loan scenarios in the calculator to see examples of how different loan.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Using the Bi-weekly Calculator for an Existing Mortgage. The 30-year fixed-rate mortgage is the.

Web This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. How Much Interest Can You Save By Increasing Your Mortgage Payment. Our Bi-Weekly Mortgage Calculator enables you to quantify your savings by showing you the earlier payoff date and lower total interest.

Over the course of a year you will make 26 payments of 35076 totalling 9120 whereas with 12 standard monthly payments you would pay only 8418. Web For example depending on the interest rate a bi-weekly mortgage is generally four-to-five years shorter than a monthly 30 year mortgage which means you save yourself up to five years in mortgage payments. Web Use our simple mortgage calculator to quickly estimate monthly payments for your new home.

The current average 30-year fixed mortgage rate is 66 according to Freddie Mac. If you take out a 30-year fixed rate mortgage this. Web Biweekly Payment Calculator is used to calculate the interest savings and total interest with biweekly payments instead of monthly.

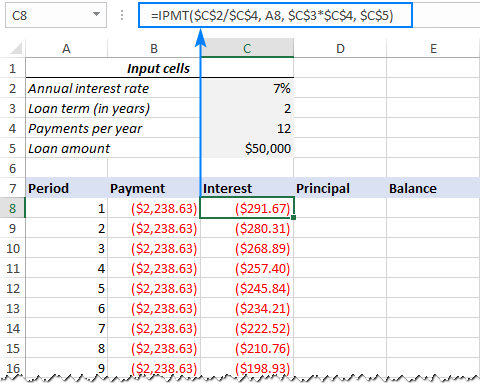

Ad See how much house you can afford. Web Heres a formula to calculate your monthly payments manually. Get The Answers You Need Here.

Bi-weekly Principal Interest. The bi-weekly payments are set to half of the original monthly payment which is like paying an extra monthly payment each year to pay off the loan faster save on interest. Estimate your monthly mortgage payment.

This free mortgage tool includes principal and interest plus estimated taxes insurance PMI and current mortgage rates. M P r 1 r n 1 r n - 1 Next steps in paying off your mortgage If you want to accelerate the payoff process you can make. Your bi-weekly payment will simply be half of what a monthly payment would be for the same loan.

Web A bi-weekly payment would be half of that 35076. Web This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis.

Biweekly Mortgage Payment Calculator For An Existing Mortgage

Htc8jknkzfke4m

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Mortgage Amortization Calculator With Extra Payments

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Welcome To Bisaver The Best Biweekly Mortgage Payment System Bisaver Biweekly

U S Mortgage Rates Climb To 5 For First Time In A Decade

Can I Get A 30 Year Mortgage In Canada Nesto Ca

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage

The 30 30 3 Home Buying Rule To Follow Financial Samurai

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Current Interest Only Mortgage Rates Freeandclear

Create A Loan Amortization Schedule In Excel With Extra Payments

Tpo Marketing Workflow Tax Service Products Mwf Shifts Wholesale Gears Reali Gone

Bi Weekly Mortgage Amortization Calculator With Extra Payments

Biweekly Mortgage Calculator

Biweekly Payments Mortgage Calculator Nerdwallet