200db depreciation calculator

The calculator also estimates the first year and the total vehicle depreciation. The percentage is calculated based on the service life of the asset.

Appliance Depreciation Calculator

This limit is reduced by the amount by which the cost of.

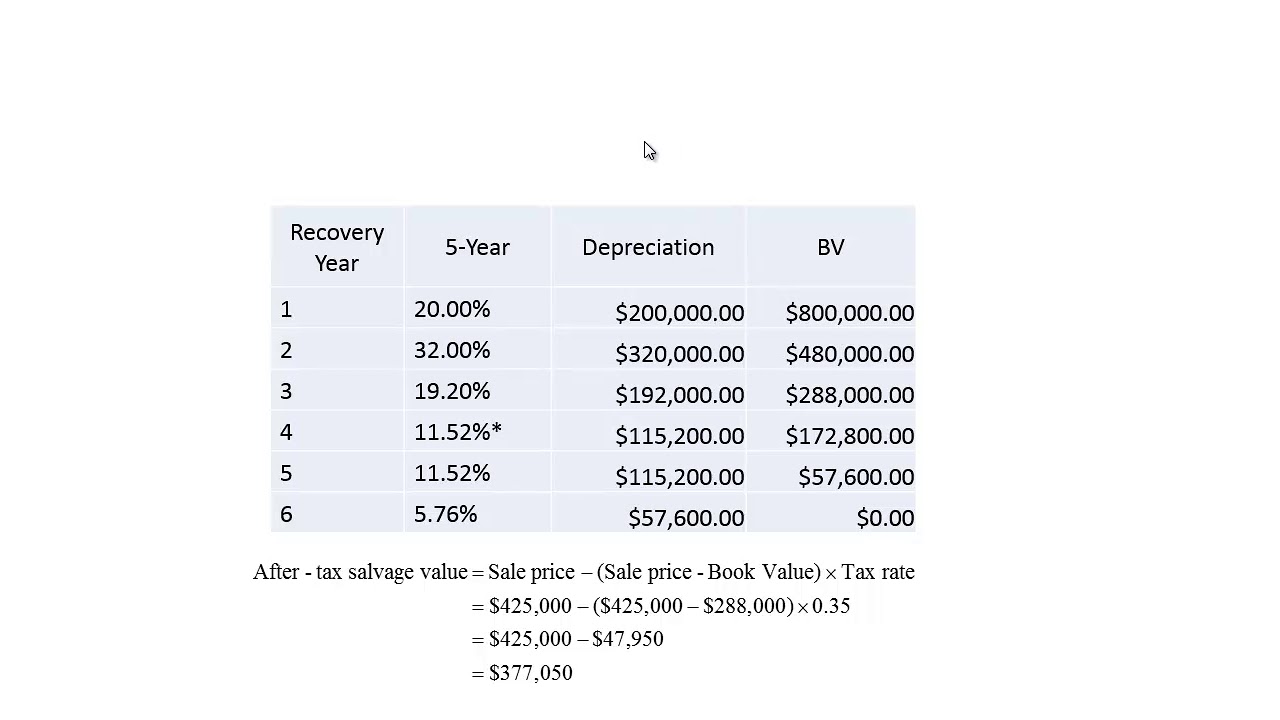

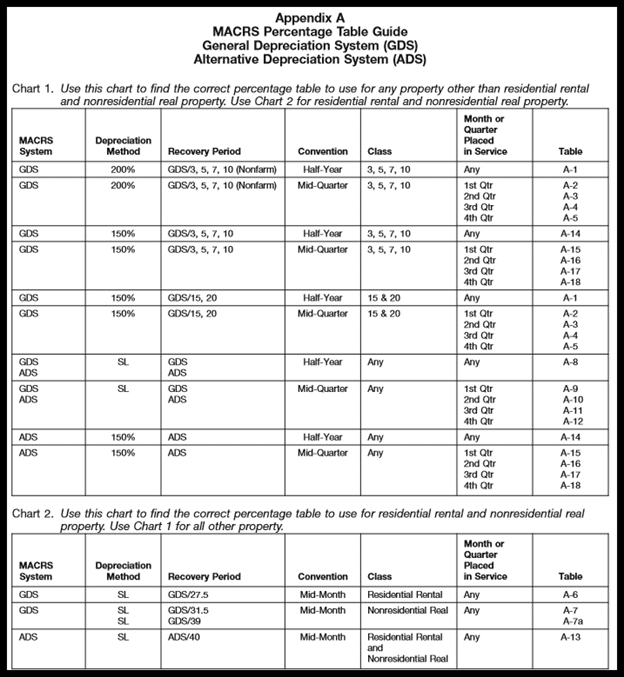

. Select the currency from the drop-down list optional Enter the. The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate. This article presents an overview of the 150 percent reducing balance method of depreciation.

Section 179 deduction dollar limits. 4562 Half Year Mid Month And Quarter Conventions 1120 1120s. It is determined based on the depreciation system GDS or ADS used.

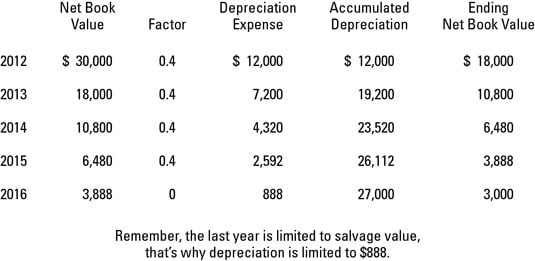

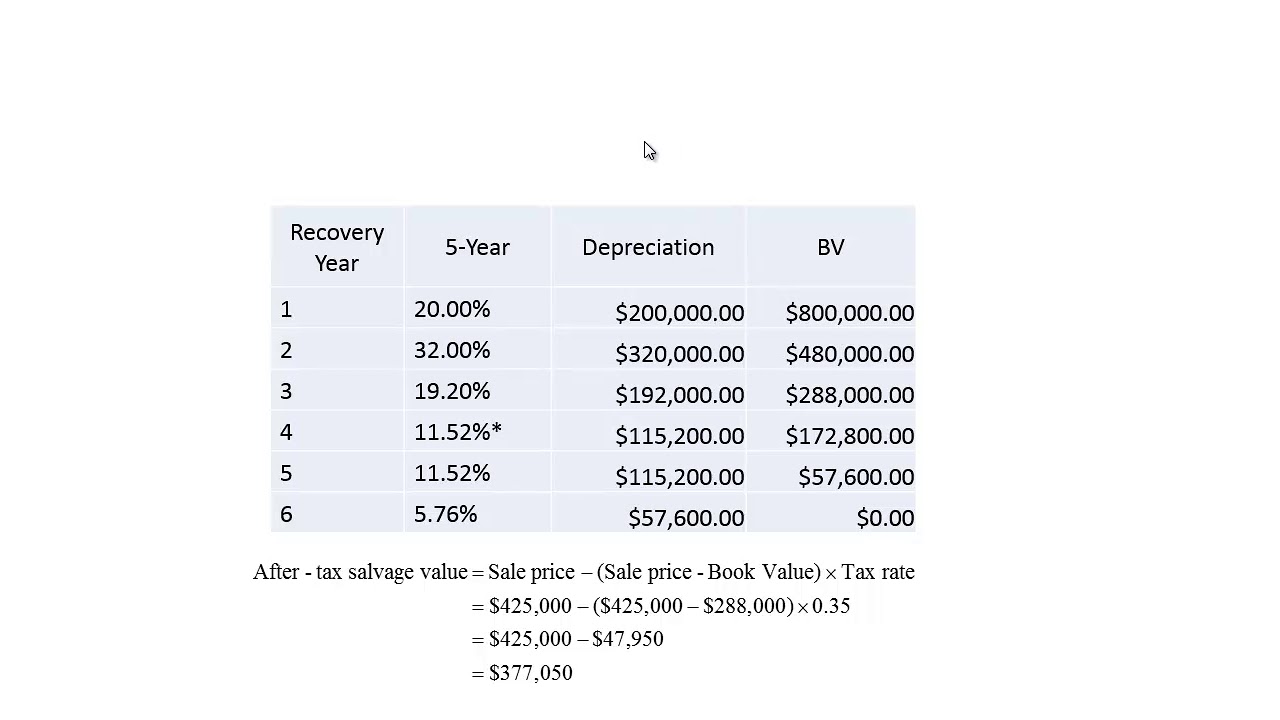

For example if an asset has a service life of five years the percentage is calculated as 40 percent 200 5. In this article. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

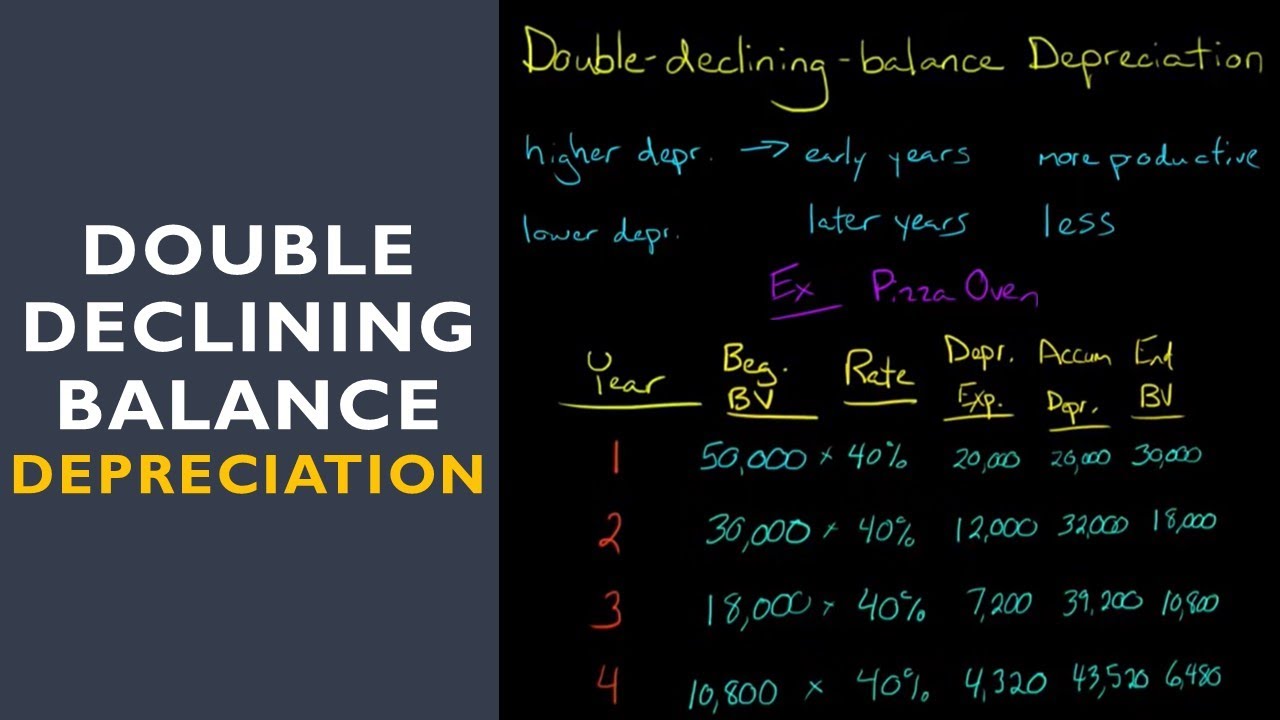

The double means 200 of the straight line rate of depreciation while the declining balance refers to the assets book value or carrying value at the beginning of the accounting period. It is fairly simple to use. The following methods are used.

When you set up a fixed asset depreciation profile and select. Macrs Depreciation Tables How To Calculate. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

The recovery period of property is the number of years over which you recover its cost or other basis. Table 8 2 Accelerated Depreciation For Personal Chegg Com. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

All you need to do is. Can someone please explain me how depreciation calculation happens for all 5 years with following financial information.

2

Double Declining Balance Depreciation Calculator

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Irs Publication 946

How To Calculate Macrs Depreciation When Why

Depreciation Methods Dummies

2

Guide To The Macrs Depreciation Method Chamber Of Commerce

How To Use The Excel Ddb Function Exceljet

The Mathematics Of Macrs Depreciation

Double Declining Balance Calculator For Depreciating Assets

Depreciation Macrs Youtube

Macrs Depreciation Calculator Straight Line Double Declining

Double Declining Depreciation Calculator 100 Free Calculators Io

Free Macrs Depreciation Calculator For Excel

Double Declining Depreciation Calculator Efinancemanagement

How To Use The Excel Db Function Exceljet